How Construction Accounting Can Help You Stay on Track with Your Budget

How Construction Accounting Can Help You Stay on Track with Your Budget

Blog Article

Secret Solutions Offered in Building Bookkeeping to Improve Financial Oversight

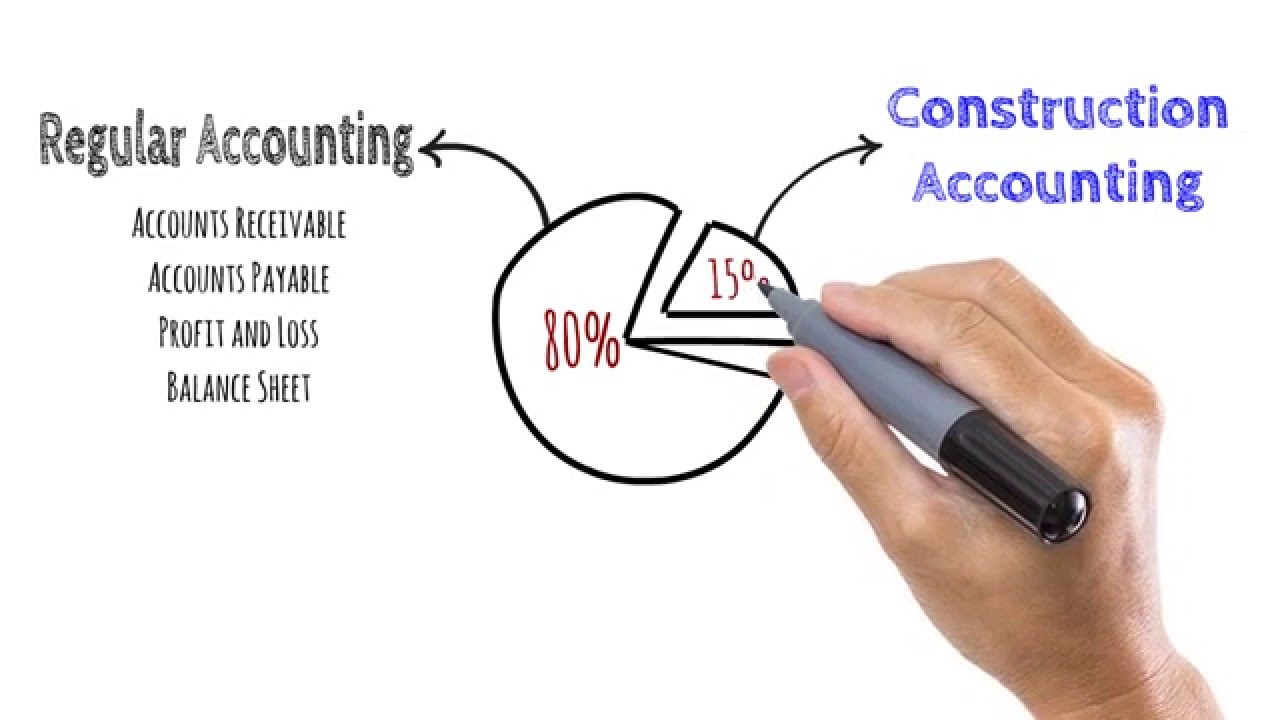

In the world of building and construction accounting, crucial solutions such as project price estimate, spending plan management, and cash circulation evaluation play an essential function in enhancing financial oversight. Understanding these subtleties can substantially affect the efficiency of financial oversight in building projects.

Project Price Evaluation

Efficient project cost estimation is a critical part of effective building accountancy services, as it straight affects budgeting and monetary planning (construction accounting). Accurate price quotes offer a comprehensive overview of the economic needs for a building and construction job, allowing stakeholders to make informed choices concerning resource appropriation and job feasibility

An extensive cost estimate process incorporates different elements, consisting of labor, materials, tools, overhead, and contingencies. By assessing historical information and present market trends, building accountants can create reasonable price quotes that show real job prices. This analytical approach not only help in protecting funding yet likewise improves transparency and accountability among all parties entailed.

Additionally, accurate expense estimate works as a structure for monitoring and controlling expenditures throughout the project's lifecycle. By establishing a clear standard, construction accounting professionals can identify inconsistencies in between estimated and real costs, permitting prompt adjustments and interventions.

Inevitably, effective job expense estimate not only facilitates smoother project implementation yet also strengthens the general economic health of construction organizations, ensuring they stay affordable in a significantly vibrant industry. This calculated approach underscores the significance of experienced specialists in supplying trustworthy and exact price price quotes.

Spending Plan Management

In the realm of building accountancy solutions, budget plan administration plays a pivotal role in making certain that tasks continue to be monetarily sensible and on course. Reliable spending plan administration includes the methodical preparation, surveillance, and managing of job expenses to align with financial objectives. It starts with the production of an in-depth spending plan that accurately mirrors the awaited expenses of labor, materials, equipment, and expenses based upon extensive project expense estimate.

As soon as the budget plan is established, ongoing surveillance is crucial. This consists of regular analyses of real expenditures against the allocated figures, allowing for prompt identification of discrepancies. By applying tools and software application tailored for building and construction accountancy, project supervisors can produce real-time reports that assist in informed decision-making.

In addition, aggressive budget plan management makes it possible for stakeholders to change economic allowances and resources as needed, promoting versatility in feedback to unexpected obstacles. This adaptability is important in the construction sector, where task extents can frequently alter. Ultimately, robust spending plan management not just bolsters monetary liability but likewise enhances general task performance, making sure effective completion within the designated economic parameters.

Money Circulation Analysis

Money circulation evaluation serves as an important part of construction accountancy, making it possible for task managers to preserve a clear understanding of the inflow and discharge of funds throughout the task lifecycle. This logical procedure allows for the identification of prospective money scarcities or surpluses, encouraging managers to make educated decisions relating to budgeting and source appropriation.

By meticulously tracking cash inflows from customer payments, car loans, and various other profits resources, along with checking discharges such as labor, materials, and overhead expenditures, project managers the original source can create a thorough money flow projection - construction accounting. This projection not only help in forecasting future financial placements but also assists in identifying trends that might influence task viability

Normal capital evaluation assists in timely interventions, permitting job managers to address economic difficulties before they rise. This positive approach can minimize dangers related to postponed repayments or unexpected expenditures, eventually leading to even more successful job completions. In addition, efficient capital management adds to maintaining solid connections with subcontractors and distributors by making sure timely settlements.

Basically, cash money flow evaluation is an important tool in building audit, driving financial security and functional efficiency throughout the duration of building and construction jobs.

Regulatory Conformity Assistance

Regulatory conformity assistance is essential for building companies browsing the complex landscape of industry policies and requirements. The building and construction industry goes through a myriad of regional, state, and government laws, including security requirements, labor regulations, and ecological guidelines. Non-compliance can result in considerable charges, hold-ups, and reputational damages.

A durable conformity assistance system aids companies stay notified regarding pertinent laws and makes certain that they implement required policies and procedures. This includes tracking modifications in regulations, providing training for employees, and carrying out routine audits to analyze compliance degrees. Building accounting professionals play a critical duty in this procedure, supplying proficiency to interpret laws and straighten economic methods appropriately.

Additionally, regulative compliance support incorporates the prep work and entry of needed paperwork, such as tax filings and reporting for labor requirements. By establishing an aggressive conformity method, building firms can mitigate risks linked with non-compliance, boost operational efficiency, and cultivate a society of responsibility.

Ultimately, reliable regulative compliance support not only safeguards a construction company's monetary health yet likewise strengthens its reputation in the sector, positioning it for sustainable development and success.

Financial Coverage and Insights

While navigating the intricacies of the construction market, exact financial reporting and informative evaluation are essential for notified decision-making. Building and construction projects commonly entail significant capital expense and fluctuating expenses, making it necessary for stakeholders to have access to prompt and clear financial data. Detailed economic records, consisting of profit and loss statements, money circulation estimates, and annual report, offer a picture of a firm's economic wellness and performance.

Moreover, tailored insights obtained from these reports assistance supervisors recognize trends, assess project success, and make tactical modifications to enhance operational effectiveness. Secret performance signs (KPIs) particular to building and construction-- such as task margins, labor prices, and overhanging proportions-- supply beneficial standards for examining success and projecting future performance.

Furthermore, regular financial coverage enables compliance with legal obligations and fosters transparency with investors and stakeholders. By leveraging innovative accountancy software application and data analytics, construction firms can boost their monetary oversight, enabling them to browse uncertainties better. Inevitably, description durable monetary reporting and workable insights empower building and construction business to make educated choices that advertise growth and sustainability in a very affordable market.

Conclusion

In the world of building and construction accounting, essential services such as job expense evaluation, budget plan management, and cash circulation evaluation play an essential duty in improving economic oversight. Inevitably, durable spending plan monitoring not just boosts monetary responsibility however likewise improves overall project efficiency, ensuring effective conclusion within the designated monetary parameters.

Report this page